The keyword “Finviz Futures” is increasingly gaining popularity among traders who are looking to track the futures market effectively. Finviz is a powerful platform that provides users with a range of tools for visualizing financial data, and futures are a critical component for investors who want to anticipate market movements. Finviz Futures help traders understand market trends, analyze sentiment, and make informed decisions based on real-time data.

Finviz provides an intuitive dashboard that aggregates data from different futures markets, including commodities, indices, and currencies. This allows traders to have a comprehensive view of the market at any given moment. Whether you are an experienced trader or just starting, understanding how to use Finviz Futures can significantly enhance your ability to forecast market trends and react accordingly.

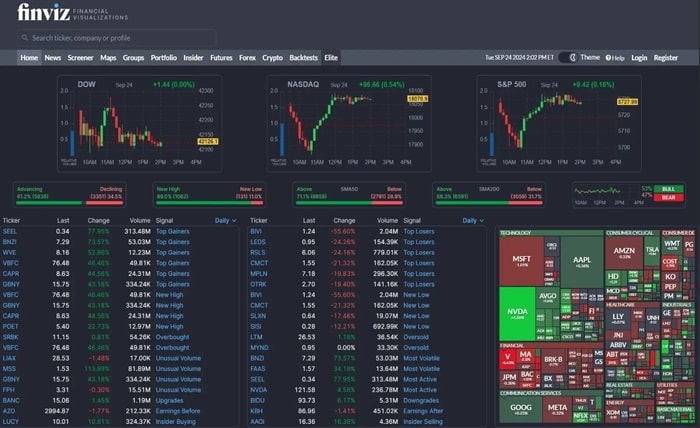

How to Navigate the Finviz Futures Dashboard

Navigating the Finviz Futures dashboard is essential for traders aiming to leverage real-time market data. When you access the Finviz website, the futures tab presents an overview of various futures contracts across sectors like commodities, indices, and energy. Using Finviz Futures, traders can quickly spot opportunities, such as changes in commodity prices or indices fluctuations.

The dashboard is organized into different categories, allowing users to easily track sectors that interest them. Finviz Futures make it easy to visually identify trends using color-coded charts. For instance, green signifies upward movement, while red indicates a downtrend. The easy navigation tools that Finviz provides enable users to gain quick insights into market performance, aiding them in making informed trading decisions.

Benefits of Using Finviz Futures for Market Analysis

Finviz Futures are an essential tool for investors looking for an edge in market analysis. One of the key advantages of using Finviz is the ability to access a wide array of market data without the need for multiple platforms. Whether it’s commodities, indices, or currencies, Finviz Futures allows traders to track all these from one dashboard, providing an all-in-one analysis solution.

Finviz Futures provide visual representations of market data, making it easier to interpret complex information. The charts, heat maps, and summary tables help traders quickly identify trends, set alerts for potential breakouts, and assess market sentiment. This, in turn, makes the decision-making process much faster and more efficient. Furthermore, for those just learning, Finviz provides educational tools to help beginners understand futures markets.

Finviz Futures: Key Features and Tools

The keyword “Finviz Futures” is often associated with several powerful features that facilitate comprehensive market analysis. One of these features is the heat map, which shows the performance of different futures contracts at a glance. The heat map is color-coded, making it easy to see which contracts are performing well and which are lagging.

Another essential tool that Finviz Futures offers is the interactive chart feature. This allows users to examine historical price trends, add technical indicators, and perform trend analysis. There are also advanced screeners available to filter futures based on criteria like performance, volatility, or volume. These tools give traders a significant advantage, as they can easily isolate opportunities that fit their trading strategy.

How to Use Finviz Futures to Predict Market Trends

Finviz Futures are incredibly useful for predicting market trends and anticipating price movements. The charts and data presented in Finviz help traders analyze historical data, which can be critical in identifying trends that are likely to continue. Traders can use moving averages, relative strength indicators, and trend lines directly on Finviz to enhance their market analysis.

Using Finviz Futures for trend prediction is particularly helpful when dealing with volatile assets like commodities and indices. By identifying trends early, traders can position themselves for profitable moves. The platform also provides access to news feeds, enabling users to stay updated on global events that may impact futures prices.

Trading Strategies Using Finviz Futures

Trading with Finviz Futures involves utilizing various strategies that cater to different market conditions. One common strategy is the trend-following approach, where traders use Finviz Futures charts to spot consistent price movements. Once a trend is established, traders can either enter long or short positions based on the direction of the trend.

Another strategy that can be implemented using Finviz Futures is the breakout strategy. With Finviz, traders can set alerts for significant price levels or technical indicators such as Bollinger Bands. When prices break through these levels, traders can enter positions with the expectation that the price movement will continue. Both beginners and experienced traders can benefit from learning and applying different strategies on Finviz.

Understanding Commodity Futures on Finviz

Commodity futures are among the most actively traded contracts on Finviz Futures. Commodities like gold, crude oil, and natural gas are highly sensitive to global economic events, making them popular among traders. Finviz allows users to easily track and analyze these commodity futures, enabling them to make informed trading decisions.

With Finviz Futures, users can see the performance of different commodities in real time. This feature is especially helpful for traders who focus on commodities as a hedge against inflation or as part of a diversified portfolio. By analyzing historical charts and keeping up with market news, traders can gain a better understanding of the factors that influence commodity prices.

Currency Futures Analysis Using Finviz Futures

Currency futures are another important part of the Finviz Futures platform. Traders who wish to speculate on currency pairs or hedge foreign exchange exposure can leverage Finviz to monitor these futures contracts. The platform displays currency futures, allowing users to keep track of significant pairs such as EUR/USD, GBP/USD, and others.

By using Finviz Futures to analyze currency markets, traders can spot trends and assess how global economic events impact currency prices. The combination of charting tools, news updates, and interactive data makes Finviz a valuable tool for currency traders. Moreover, the platform offers insights into correlations between different assets, which can be helpful when assessing the overall health of the financial markets.

How to Integrate Finviz Futures with Your Trading Plan

Integrating Finviz Futures with your trading plan can significantly enhance your overall strategy. For instance, traders can use Finviz to set alerts based on price movements or technical indicators. These alerts help traders react promptly to market changes, ensuring they do not miss trading opportunities.

In addition, using Finviz Futures as part of your analysis allows for a holistic view of the market. The visual tools provided help traders understand market dynamics better, which is crucial for making strategic decisions. By incorporating data from Finviz, traders can enhance their risk management strategies and ensure they are well-prepared for different market conditions.

Conclusion

Finviz Futures provide traders with a powerful toolset for analyzing and understanding futures markets. From commodities to indices and currencies, the platform offers comprehensive data in an easy-to-understand format. Traders can leverage the various features, such as heat maps, charts, and alerts, to improve their trading strategies and make more informed decisions.

The keyword “Finviz Futures” is more than just a buzzword—it’s a gateway to better market analysis and strategic trading. Whether you are new to futures or have years of trading experience, using Finviz Futures can help you stay ahead in the highly competitive world of trading.

FAQs

1. What is Finviz Futures?

Finviz Futures is a tool offered by the Finviz platform that provides data, charts, and insights into various futures markets, including commodities, indices, and currencies.

2. How do I use Finviz Futures for trading?

You can use Finviz Futures to track market trends, analyze charts, and set alerts for specific price movements to improve your trading decisions.

3. Can beginners use Finviz Futures?

Yes, beginners can use Finviz Futures as the platform offers easy-to-understand visual tools and educational resources to help new traders learn the basics.

4. Are Finviz Futures suitable for day trading?

Finviz Futures can be used for day trading, as it provides real-time data and charts that are essential for making quick trading decisions.

5. How much does Finviz cost?

Finviz offers both free and premium (Finviz Elite) versions. The premium version provides advanced tools and data, including real-time updates and additional charting capabilities.