Intel Corporation (INTC) is a dominant player in the global semiconductor industry, well-known for its innovations in microprocessors and other computing technologies. Investors and analysts often turn to Finviz, a popular financial visualization tool, to assess Intel’s stock performance and evaluate its financial health. In this blog post, we’ll explore how to use the Finviz platform to understand Intel’s financial metrics, stock chart, insider trading data, and much more. By the end of this post, you’ll be equipped with the knowledge to interpret INTC’s performance and make informed investment decisions.

What is Finviz and Why Use it for INTC?

Finviz is an online financial tool that provides users with access to a variety of stock market data, including real-time charts, financial statements, insider trading information, and much more. It is widely used by investors and analysts for stock screening and analysis.When it comes to tracking INTC on Finviz, the platform provides a clear and accessible way to evaluate Intel’s stock and financial health. It offers an interactive stock chart, which includes key technical indicators such as price trends, moving averages, volume, and more. Additionally, Finviz aggregates data from various financial reports, such as the company’s earnings, revenue growth, debt-to-equity ratio, and other vital metrics. This enables users to get a comprehensive overview of Intel’s market performance and make informed decisions based on solid data.

Key Financial Metrics to Analyze INTC on Finviz

Analyzing INTC on Finviz requires understanding several key financial metrics that provide insight into the company’s performance. These metrics are crucial for assessing Intel’s profitability, growth prospects, and overall financial health.

- Price-to-Earnings (P/E) Ratio: The P/E ratio is an important valuation metric used to determine whether a stock is overvalued or undervalued. A low P/E ratio could indicate that INTC’s stock is undervalued relative to its earnings potential, while a high P/E ratio may suggest the opposite.

- Earnings Per Share (EPS): EPS is a critical indicator of Intel’s profitability. By checking INTC’s EPS on Finviz, investors can gauge how much profit Intel generates on a per-share basis. A growing EPS suggests that the company is increasing its profitability, which can be a positive sign for investors.

- Revenue Growth: Revenue growth is another essential metric available on Finviz. Analyzing INTC’s revenue growth over the past few quarters or years can help you assess how well the company is expanding its business and generating sales. Consistent growth in revenue can indicate that Intel is performing well in a competitive market.

- Debt-to-Equity Ratio: This ratio measures Intel’s financial leverage by comparing its total debt to its shareholders’ equity. A higher debt-to-equity ratio could suggest that Intel is relying heavily on debt to finance its operations, which could be a red flag for some investors. On Finviz, you can easily find this ratio to understand how much debt Intel is carrying.

By focusing on these key metrics and others available on Finviz, you can gain a deeper understanding of Intel’s financial performance and make more informed decisions regarding its stock.

Tracking INTC’s Stock Chart on Finviz

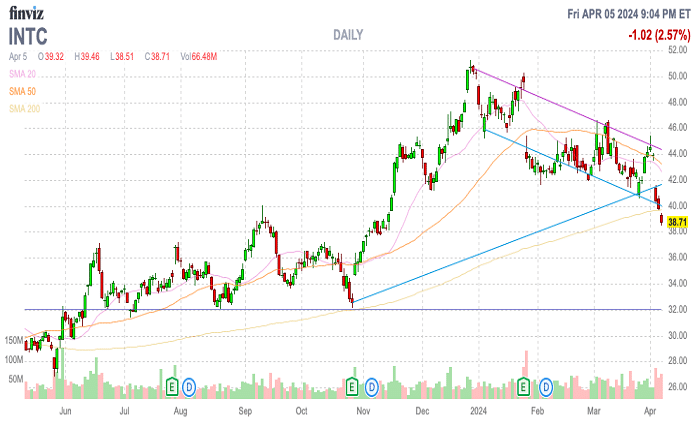

The stock chart on Finviz is one of the most valuable tools for investors when analyzing INTC’s price action. The chart offers a visual representation of how Intel’s stock has performed over time, showing trends, price fluctuations, and trading volumes.Finviz allows users to customize the chart based on their preferred timeframes, whether it’s intraday, daily, weekly, or monthly. This flexibility helps investors identify short-term and long-term trends in Intel’s stock price. You can also overlay different technical indicators, such as moving averages, relative strength index (RSI), and Bollinger Bands, which provide additional insight into INTC’s market momentum.For example, a rising 50-day moving average could signal that Intel’s stock is in an uptrend, while a falling RSI might indicate that the stock is becoming oversold, presenting a potential buying opportunity. Tracking these indicators on Finviz is essential for evaluating INTC’s short-term and long-term prospects.

Insider Trading Data on INTC via Finviz

Insider trading refers to the buying and selling of a company’s stock by its executives, directors, or employees. This information is particularly important because it can offer clues about the outlook for the company’s future. If insiders are buying large amounts of INTC stock, it could indicate that they believe the company’s prospects are strong.Finviz makes it easy to track insider trading activity for INTC by displaying a comprehensive list of recent insider transactions. This can help you understand whether Intel’s leadership is confident in the company’s future performance. For example, if there is a surge in insider buying, it might suggest that insiders are optimistic about Intel’s upcoming product launches or strategic initiatives.However, insider selling could raise some red flags, especially if it occurs at a high level or during periods of stock price volatility. By closely monitoring INTC’s insider transactions on Finviz, you can gain valuable insights into the company’s future prospects.

Understanding INTC’s News and Market Sentiment on Finviz

Another essential feature of Finviz is its comprehensive news section, which aggregates the latest headlines and news stories about INTC. Whether it’s related to earnings reports, product launches, regulatory developments, or other factors, Finviz brings real-time news directly to users’ screens.Keeping an eye on INTC’s news and market sentiment can help investors anticipate potential price movements. For instance, positive news such as a breakthrough in semiconductor technology or a major partnership could lead to a rise in Intel’s stock price. On the other hand, negative news like an earnings miss or regulatory concerns could cause a decline in the stock’s value.By combining this news information with the financial metrics and stock chart analysis, you can form a more comprehensive view of Intel’s performance and outlook.

INTC’s Valuation and Comparison with Peers on Finviz

When analyzing INTC on Finviz, it’s essential to compare the company’s valuation to that of its industry peers. Intel operates in the highly competitive semiconductor sector, and comparing its financial metrics, P/E ratio, revenue growth, and market capitalization to other companies in the same space can provide valuable context.On Finviz, you can access data about INTC’s competitors, such as AMD, Nvidia, and Qualcomm. By comparing these companies’ financials and stock performance, you can determine whether INTC is underperforming, overperforming, or on par with its peers. This comparative analysis can be crucial for making investment decisions.Additionally, Finviz provides a “Sector/Industry” tab that allows you to see how Intel is performing relative to the overall semiconductor sector. This can help you gauge whether INTC’s stock movements are driven by company-specific factors or broader industry trends.

Conclusion

In conclusion, tracking INTC on Finviz offers investors a powerful tool for understanding Intel’s financial health, stock performance, and market outlook. With its easy-to-navigate interface and comprehensive data, Finviz allows users to access everything they need to make informed investment decisions, from financial metrics to insider trading data and stock charts.By carefully analyzing Intel’s performance using the key metrics discussed in this post, investors can develop a more nuanced understanding of the company and its prospects. Additionally, staying updated on market news, tracking stock trends, and comparing Intel’s performance with its peers can provide valuable insights into potential investment opportunities.Ultimately, Finviz serves as a valuable resource for both novice and seasoned investors looking to stay informed and make strategic decisions regarding INTC.

FAQs

1. What is the P/E ratio of INTC on Finviz, and how does it affect my investment decision?

The P/E ratio of INTC can be found on Finviz and reflects how much investors are willing to pay for each dollar of Intel’s earnings. A lower P/E ratio might indicate that the stock is undervalued, while a higher P/E ratio suggests it might be overvalued. Comparing INTC’s P/E ratio to industry peers can offer more context.

2. How can I use Finviz to track INTC’s stock chart and identify potential buying opportunities?

You can customize the stock chart on Finviz to view different timeframes and overlay technical indicators like moving averages, RSI, and Bollinger Bands. These tools can help you identify trends and potential buy signals for INTC.

3. What does insider trading data tell me about INTC’s future performance?

Insider trading data on Finviz shows the buying and selling activity of Intel’s executives and employees. Large-scale insider buying could indicate confidence in the company’s future, while heavy insider selling might raise concerns about its prospects.

4. How does INTC compare to other semiconductor companies on Finviz?

Finviz allows you to compare INTC’s financial metrics, stock performance, and market valuation with other semiconductor companies such as AMD, Nvidia, and Qualcomm. This comparison helps you assess how Intel is performing relative to its competitors.

5. Can I use Finviz to track Intel’s earnings reports and market sentiment?

Yes, Finviz aggregates news about Intel, including earnings reports and other significant developments. Monitoring this news can help you stay informed about Intel’s performance and the factors that may affect its stock price.