Introduction

In the dynamic world of finance, mastering the art of stock search is crucial for investors looking to make informed decisions and maximize their returns. Stock search involves identifying and analyzing potential investment opportunities in the stock market. This comprehensive guide will walk you through the essentials of stock search, offering insights into various tools, techniques, and strategies to help you navigate the complexities of the market.

Stock Search

Stock search is the process of identifying potential investment opportunities by evaluating various stocks available in the market. It involves analyzing financial statements, market trends, and other relevant data to make informed decisions. Stock search is essential for investors looking to build a diversified portfolio and achieve their financial goals.

Importance of Stock Search in Investing

The importance of stock search cannot be overstated. By conducting thorough research, investors can identify undervalued stocks, avoid potential pitfalls, and enhance their overall investment strategy. Stock search helps investors understand the financial health of companies, assess their growth potential, and make decisions that align with their risk tolerance and investment objectives.

Tools and Resources for Effective Stock Search

Effective stock search requires the use of various tools and resources. Online platforms such as Yahoo Finance, Google Finance, and Bloomberg provide comprehensive data on stocks, including historical performance, financial statements, and market news. Additionally, stock screeners and analytical tools like Morningstar, Zacks, and Finviz help investors filter and evaluate stocks based on specific criteria.

Fundamental Analysis in Stock Search

Fundamental analysis is a key component of stock search. It involves evaluating a company’s financial statements, such as its income statement, balance sheet, and cash flow statement, to assess its financial health and growth potential. By analyzing metrics like earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE), investors can gain insights into a company’s profitability and long-term prospects.

Technical Analysis in Stock Search

Technical analysis is another important aspect of stock search. This method involves analyzing historical price and volume data to identify patterns and trends that can predict future price movements. Tools such as moving averages, relative strength index (RSI), and Bollinger Bands help investors make informed decisions based on market trends and price action.

Evaluating Company Performance

Evaluating a company’s performance is crucial in stock search. Investors should look at key performance indicators (KPIs) such as revenue growth, profit margins, and return on assets (ROA). Additionally, examining a company’s competitive position, management team, and industry trends can provide valuable insights into its potential for long-term success.

The Role of Market Sentiment in Stock Search

Market sentiment plays a significant role in stock search. It refers to the overall attitude of investors towards a particular stock or the market as a whole. By monitoring market sentiment through news, social media, and investor forums, investors can gauge the level of optimism or pessimism surrounding a stock and make more informed decisions.

Diversifying Your Portfolio Through Stock Search

Diversification is a key strategy in investment, and stock search plays a vital role in achieving it. By identifying and investing in a variety of stocks across different sectors and industries, investors can reduce risk and improve their chances of achieving stable returns. Stock search helps investors find the right mix of stocks to create a well-balanced and diversified portfolio.

Identifying Growth Stocks

Identifying growth stocks is a crucial part of stock search for investors seeking high returns. Growth stocks are companies expected to grow at an above-average rate compared to other companies in the market. By analyzing factors such as revenue growth, market potential, and innovation, investors can identify promising growth stocks that offer significant upside potential.

Value Investing and Stock Search

Value investing is a popular investment strategy that involves identifying undervalued stocks. Stock search is essential for value investors, as it helps them find stocks trading below their intrinsic value. By focusing on fundamentals, such as low P/E ratios, strong balance sheets, and high dividend yields, value investors can uncover hidden gems in the market.

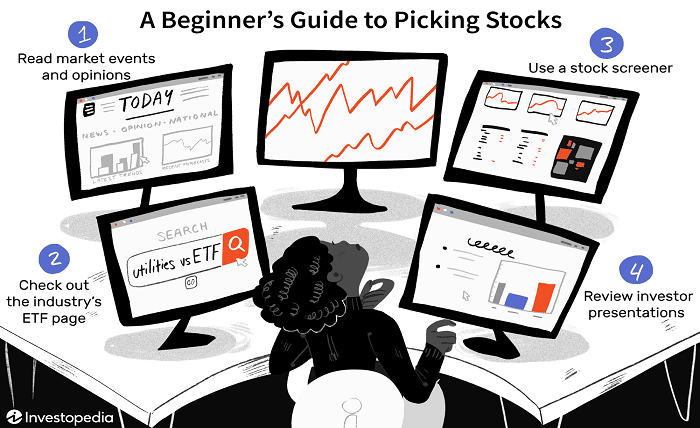

Utilizing Stock Screeners for Efficient Stock Search

Stock screeners are powerful tools that streamline the stock search process. These tools allow investors to filter stocks based on specific criteria, such as market capitalization, sector, and financial ratios. By using stock screeners, investors can quickly identify stocks that meet their investment criteria and focus their research on the most promising opportunities.

Staying Informed with Real-Time Data

Access to real-time data is crucial for effective stock search. Investors need to stay updated with the latest market news, earnings reports, and economic indicators. Online platforms and financial news apps provide real-time data and alerts, helping investors make timely decisions and stay ahead of market trends.

Conclusion

Mastering stock search is essential for any investor looking to navigate the complexities of the stock market and achieve their financial goals. By understanding the importance of stock search, utilizing the right tools and resources, and employing effective analysis techniques, investors can make informed decisions and build a successful investment portfolio. Whether you’re a seasoned investor or a beginner, this comprehensive guide provides the knowledge and strategies you need to excel in stock search.

FAQs

1. What is stock search? Stock search is the process of identifying and analyzing potential investment opportunities in the stock market by evaluating various stocks based on financial data, market trends, and other relevant information.

2. Why is stock search important for investors? Stock search is important because it helps investors make informed decisions, identify undervalued stocks, avoid potential risks, and build a diversified investment portfolio.

3. What tools are commonly used for stock search? Common tools for stock search include online platforms like Yahoo Finance and Bloomberg, stock screeners like Morningstar and Finviz, and analytical tools that provide financial data and market trends.

4. How does fundamental analysis aid in stock search? Fundamental analysis aids in stock search by evaluating a company’s financial health and growth potential through its financial statements, allowing investors to assess profitability and long-term prospects.

5. What role does technical analysis play in stock search? Technical analysis plays a role in stock search by analyzing historical price and volume data to identify patterns and trends, helping investors predict future price movements and make informed decisions.