Introduction

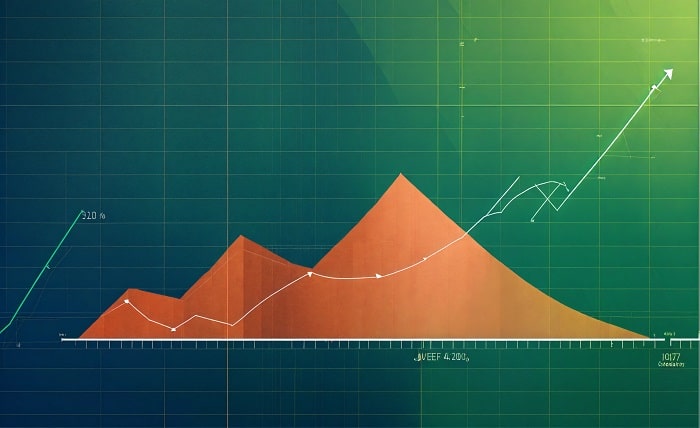

Stock charts are invaluable tools for traders and investors, providing a visual representation of stock prices over time. These charts help users identify trends, patterns, and potential trading opportunities in the market. By the end of this section, you will understand the basics of what stock charts are and why they are crucial for successful investing.

Chart Types

There are several types of stock charts, each with its unique way of presenting data. Line charts, bar charts, and candlestick charts are the most commonly used. This section will explore each type, highlighting their specific uses and advantages in stock market analysis.

The Components of Stock Charts

Every stock chart consists of several key components, including the price axis, time axis, volume bars, and sometimes indicators. Understanding these elements is essential to effectively read and interpret stock charts for better investment decisions.

Reading Candlestick Patterns

Candlestick patterns are especially popular among stock chart users because they provide more information than simple line or bar charts. We’ll delve into the basics of reading candlestick patterns and how they can signal buying or selling opportunities.

Technical Indicators and Stock Charts

Technical indicators are mathematical calculations based on stock price and volume. They are used to predict future price movements. This section covers common indicators like moving averages, Relative Strength Index (RSI), and MACD, and how they enhance the analysis provided by stock charts.

The Role of Volume in Stock Charts

Volume is a critical component of stock charts, providing insights into the strength of price movements. This part of the post will explain how to interpret volume alongside price changes to gauge market sentiment and potential price trends.

Time Frames and Their Impact

Stock charts can be viewed in various time frames—from minutes to years—depending on the trader’s strategy and goals. This section discusses how choosing the right time frame affects the information and insights gained from stock charts.

How to Use Stock Charts for Trading Decisions

Integrating the information from stock charts into trading decisions can be daunting for beginners. Here, we’ll provide practical tips on using stock charts to make informed trading choices, including entry and exit points.

Common Mistakes to Avoid with Stock Charts

Many new traders make predictable errors when using stock charts, such as misinterpreting patterns or overloading charts with too many indicators. This section aims to highlight these common pitfalls and how to avoid them.

Advanced Strategies Using Stock Charts

For those ready to go beyond the basics, this section introduces advanced strategies in using stock charts, such as Fibonacci retracements and Elliot Wave theory, to predict market movements more accurately.

Integrating Stock Charts with Fundamental Analysis

While stock charts are powerful tools, they are most effective when combined with fundamental analysis. This part discusses how to blend technical chart analysis with fundamental metrics like earnings, economic indicators, and industry trends.

Conclusion

Stock charts are a fundamental part of trading and investing in the stock market. By understanding and utilizing various chart types and technical indicators, you can enhance your ability to make informed investment decisions. Remember, the key to successful stock chart analysis is practice and continuous learning.

FAQs about Stock Charts

1. What is the best stock chart for beginners?

- Candlestick charts are highly recommended for beginners because they provide more information than line and bar charts, making them easier to read and interpret.

2. How often should I check stock charts?

- The frequency depends on your trading strategy. Day traders may check charts several times a day, while long-term investors might review them less frequently, such as weekly or monthly.

3. Can stock charts predict stock prices accurately?

- While stock charts provide valuable insights into historical price actions and trends, they cannot predict future prices with complete accuracy. They should be used as part of a broader analysis strategy.

4. Do I need special software to view stock charts?

- Many online brokers and trading platforms provide stock charting tools as part of their service. There are also several free and paid charting software options available online.

5. Are there any resources to learn more about stock charts?

- Yes, numerous online courses, books, and tutorials are dedicated to teaching stock chart analysis. Investing in such resources can be beneficial for deepening your understanding of how to use stock charts effectively.