The Finviz heatmap is an essential tool for stock market enthusiasts, offering a visual representation of market performance. It enables users to identify trends, monitor sector performance, and make informed decisions. Whether you’re a seasoned investor or just starting, the Finviz heatmap can transform your approach to stock analysis. This guide will explore its features, advantages, and practical applications, ensuring you harness its full potential.

What Is the Finviz Heatmap?

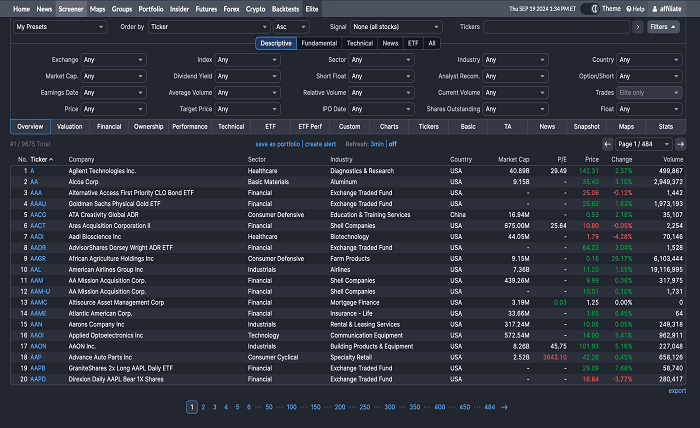

The Finviz heatmap is a color-coded chart that displays the performance of stocks, sectors, and indices in a visually intuitive manner. Each stock or sector is represented as a block, with its size and color reflecting its market capitalization and performance. Green signifies positive performance, red indicates negative performance, and varying shades show intensity. By simplifying complex data, the Finviz heatmap helps traders and investors spot trends and anomalies at a glance.

How to Access and Navigate the Finviz Heatmap

Accessing the Finviz heatmap is straightforward. Visit the Finviz website and navigate to the heatmap section under “Maps.” The interface is user-friendly, offering various filters to customize your view. You can focus on specific sectors, industries, or market indices, ensuring the heatmap aligns with your investment strategy. Additionally, hovering over each block reveals detailed stock information, making navigation seamless.

Key Features of the Finviz Heatmap

The Finviz heatmap boasts several features that make it a favorite among investors. Some of its standout features include:

- Customization Options: Adjust filters to display specific sectors, industries, or market caps.

- Real-Time Data: Get updated market performance data to make timely decisions.

- Visual Clarity: Identify trends and patterns through intuitive color coding.

- Sector Insights: Understand how individual sectors contribute to overall market movements.

- Stock Details: Access detailed stock data, such as price, volume, and performance metrics, with a single click.

These features make the Finviz heatmap a versatile tool for market analysis.

Benefits of Using the Finviz Heatmap

Utilizing the Finviz heatmap offers numerous advantages for investors:

- Quick Market Overview: Gain an instant snapshot of market performance.

- Sector Analysis: Identify which sectors are thriving or struggling.

- Informed Decision-Making: Base your trading decisions on visual data patterns.

- Trend Identification: Spot upward or downward trends efficiently.

- Enhanced Portfolio Management: Align your investments with real-time market conditions.

By integrating the Finviz heatmap into your strategy, you can stay ahead in the dynamic stock market.

Practical Applications of the Finviz Heatmap

The Finviz heatmap serves multiple practical purposes, catering to both novice and expert investors.

- Trend Spotting: Identify bullish or bearish trends within sectors or the broader market.

- Risk Management: Detect underperforming stocks and sectors to mitigate losses.

- Stock Screening: Use the heatmap to discover potential investment opportunities.

- Sector Rotation: Recognize shifts in sector performance and adjust your portfolio accordingly.

- Technical Analysis: Combine the heatmap with technical charts for a comprehensive analysis.

These applications make the Finviz heatmap an indispensable tool for diverse investment strategies.

Tips for Maximizing the Finviz Heatmap

To leverage the Finviz heatmap effectively, follow these tips:

- Use Filters: Narrow down your view by applying filters for sectors, industries, or market caps.

- Combine with Other Tools: Integrate the heatmap with Finviz’s screener or charts for deeper insights.

- Monitor Regularly: Regular use ensures you stay updated on market movements.

- Set Goals: Define clear objectives for using the heatmap, whether for day trading or long-term investing.

- Stay Informed: Pair heatmap analysis with news updates for a holistic understanding.

By adopting these practices, you can maximize the benefits of the Finviz heatmap in your investment journey.

Limitations of the Finviz Heatmap

While the Finviz heatmap is a powerful tool, it does have some limitations:

- Limited Historical Data: The heatmap focuses on current market conditions, offering little historical context.

- Not a Standalone Tool: It works best when combined with other analysis tools.

- Complex for Beginners: The sheer amount of data can overwhelm novice investors.

- No Predictive Capabilities: The heatmap visualizes performance but doesn’t predict future trends.

- Subscription-Based Features: Advanced functionalities may require a Finviz Elite subscription.

Understanding these limitations can help you use the heatmap more effectively and set realistic expectations.

Conclusion

The Finviz heatmap is a powerful visualization tool that simplifies stock market analysis. With its intuitive interface, real-time updates, and customizable features, it empowers investors to make informed decisions. While it has some limitations, combining it with other tools and staying informed ensures you maximize its potential. Whether you’re tracking trends, analyzing sectors, or managing risks, the Finviz heatmap is a must-have for any investor’s toolkit.

FAQs

1. What is the purpose of the Finviz heatmap?

The Finviz heatmap provides a visual representation of market performance, helping investors identify trends and analyze sectors efficiently.

2. Is the Finviz heatmap free to use?

Yes, the basic version of the Finviz heatmap is free, but advanced features require a Finviz Elite subscription.

3. How often is the Finviz heatmap updated?

The Finviz heatmap updates in real-time for Finviz Elite users, while free users may experience slight delays.

4. Can beginners use the Finviz heatmap?

While beginners may find the data overwhelming initially, the heatmap is user-friendly and can be learned quickly with practice.

5. Does the Finviz heatmap include international markets?

Currently, the Finviz heatmap primarily focuses on U.S. markets, but users can analyze ADRs and global ETFs.