Introduction

In today’s digital age, managing personal and business finances can be a complex task. However, with the right tools, this complexity can be significantly reduced. One such tool that has gained prominence is FinWiz. This comprehensive guide will walk you through what FinWiz is, how it works, and how you can leverage it to achieve financial success.

What is FinWiz?

FinWiz, short for Financial Wizard, is an advanced financial management platform designed to simplify the intricacies of personal and business finance. It offers a suite of tools and resources that help users manage their finances efficiently, from budgeting to investing.

Key Features of FinWiz

FinWiz comes packed with features that cater to various financial needs. These include budgeting tools, investment trackers, financial calculators, and educational resources. Each feature is designed to provide users with the information and insights needed to make informed financial decisions.

The Benefits of Using FinWiz

Using FinWiz can bring numerous benefits. Firstly, it provides a centralized platform for all your financial activities. Secondly, it offers real-time updates and insights, ensuring you are always informed about your financial status. Thirdly, FinWiz’s intuitive interface makes it easy for users of all levels to navigate and use.

How to Get Started with FinWiz

Getting started with FinWiz is straightforward. Simply sign up on the FinWiz website, complete your profile, and link your financial accounts. The platform will then sync your data and provide you with a comprehensive overview of your financial health.

Budgeting with FinWiz

One of the core functionalities of FinWiz is its budgeting tool. This feature allows you to set budget goals, track your spending, and adjust your budget as needed. FinWiz provides visual representations of your budget, making it easier to understand your financial habits and make necessary adjustments.

Investing with FinWiz

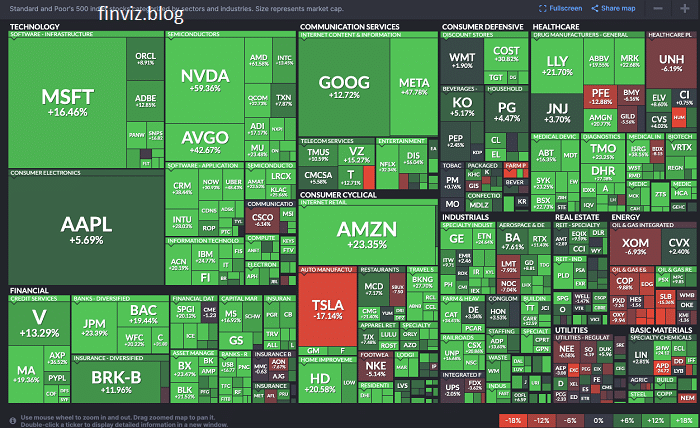

FinWiz also offers robust investment tools. You can track your investment portfolio, analyze market trends, and receive personalized investment advice. The platform’s investment tools are designed to help both novice and experienced investors make smart investment decisions.

Financial Planning with FinWiz

Financial planning is crucial for long-term financial success. FinWiz provides a range of planning tools that help you set financial goals, plan for retirement, and manage debt. These tools offer detailed projections and scenarios, allowing you to see the potential outcomes of your financial decisions.

Educational Resources on FinWiz

Education is a key component of FinWiz. The platform offers a wealth of educational resources, including articles, tutorials, and webinars. These resources cover a wide range of topics, from basic financial literacy to advanced investment strategies, helping users enhance their financial knowledge.

Security and Privacy on FinWiz

Security is a top priority for FinWiz. The platform employs advanced security measures to protect your data, including encryption and two-factor authentication. FinWiz is committed to ensuring that your financial information remains secure and confidential.

Customer Support on FinWiz

FinWiz offers excellent customer support to assist users with any issues or questions. Support is available through multiple channels, including email, chat, and phone. The FinWiz support team is knowledgeable and responsive, ensuring you receive the help you need in a timely manner.

Conclusion

FinWiz is a powerful tool that can transform the way you manage your finances. With its comprehensive suite of features, user-friendly interface, and robust security measures, FinWiz stands out as a leading financial management platform. Whether you are looking to budget better, invest wisely, or enhance your financial knowledge, FinWiz has the resources you need to succeed.

FAQs

1. What makes FinWiz different from other financial management tools?

FinWiz differentiates itself with its comprehensive features, user-friendly interface, and robust security measures. It offers a centralized platform for all financial activities, real-time updates, and extensive educational resources.

2. Is FinWiz suitable for beginners?

Yes, FinWiz is designed to be user-friendly and accessible to users of all levels. It provides educational resources and tools that cater to both novice and experienced users.

3. How secure is my data on FinWiz?

FinWiz prioritizes security with advanced measures like encryption and two-factor authentication, ensuring that your data remains secure and confidential.

4. Can FinWiz help me with investment decisions?

Absolutely. FinWiz offers robust investment tools that allow you to track your portfolio, analyze market trends, and receive personalized investment advice.

5. Is there customer support available on FinWiz?

Yes, FinWiz offers customer support through multiple channels, including email, chat, and phone. The support team is knowledgeable and responsive, providing timely assistance.