Introduction

In the dynamic world of investing, the ability to perform a thorough stock comparison is invaluable. By examining various metrics and understanding market trends, investors can make informed decisions that align with their financial goals. This blog post delves into the critical aspects of stock comparison, providing you with the knowledge to navigate the complexities of the stock market confidently.

The Basics of Stock Comparison

Stock comparison involves analyzing different stocks to determine which might offer the best returns according to your investment goals. This process includes looking at various financial metrics, company performance, and industry trends to gauge potential growth and risk.

Key Financial Ratios for Effective Stock Comparison

Financial ratios are at the heart of stock comparison. Ratios like Price-to-Earnings (P/E), Debt-to-Equity (D/E), and Return on Equity (ROE) provide insights into a company’s financial health and help compare it against its peers.

The Role of Market Capitalization in Stock Comparison

Market capitalization reflects the total market value of a company’s outstanding shares. It is a crucial factor in stock comparison as it helps investors understand the size of a company and the potential scale of its operations.

Comparing Stocks Within the Same Industry

Analyzing stocks within the same industry allows for a more apples-to-apples comparison. This section covers how to look at industry-specific metrics and benchmarks to make better-informed investment choices.

Growth vs. Value Stocks: A Comparative Analysis

Growth and value stocks appeal to different types of investors. This part of the blog explains the distinction and how to approach stock comparison when looking at these two different investment styles.

The Impact of Economic Indicators on Stock Comparison

Economic indicators like GDP growth, unemployment rates, and consumer confidence can significantly affect stock prices. Understanding these can enhance your stock comparison strategy, particularly in volatile markets.

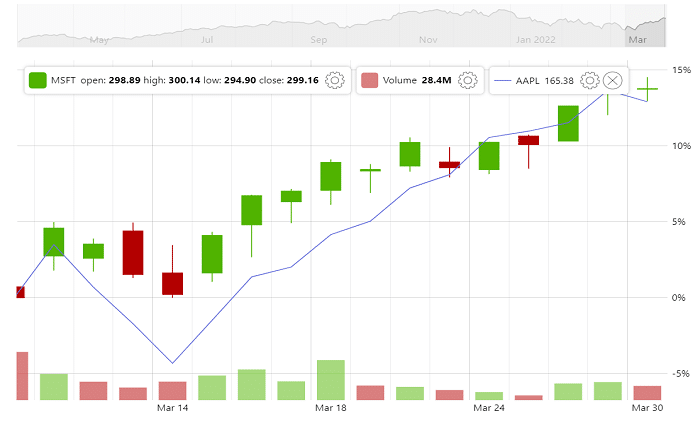

Utilizing Technical Analysis for Stock Comparison

Technical analysis involves studying statistical trends gathered from trading activity. This section explains how to use charts and indicators to compare stock performance and predict future movements.

The Influence of Earnings Reports on Stock Comparison

Earnings reports are vital for stock comparison as they provide a snapshot of a company’s profitability and financial health. Learn how to interpret these reports to make more informed investment decisions.

Diversification and Stock Comparison

Diversification is a key investment strategy to mitigate risk. This part discusses how stock comparison can aid in creating a diversified portfolio that balances risk and return.

Advanced Tools and Resources for Stock Comparison

Numerous tools and resources can enhance your stock comparison efforts. This section reviews some of the top software and platforms that offer detailed analytics and comparative data.

Common Pitfalls in Stock Comparison and How to Avoid Them

Even seasoned investors can make mistakes in stock comparison. This section highlights common pitfalls and offers tips on how to avoid them, ensuring more accurate and beneficial stock analyses.

Learning from Case Studies: Real-World Stock Comparisons

Examining real-world examples of stock comparison can provide practical insights and improve your investing skills. This part explores several case studies where effective stock comparison techniques were applied.

Conclusion

Stock comparison is a fundamental skill that requires continuous learning and application. By understanding and utilizing the techniques discussed in this guide, investors can enhance their ability to pick winning stocks and ultimately achieve their investment objectives.

FAQs

1. What is the most important factor in stock comparison? The most important factor can vary based on individual investment goals, but generally, financial health metrics like P/E ratio and ROE are highly valuable.

2. How often should I compare stocks? Regular comparison is key, especially quarterly or bi-annually, to coincide with the release of new financial reports and market data.

3. Can stock comparison predict stock prices accurately? While no method can predict stock prices with absolute accuracy, effective stock comparison can significantly increase the likelihood of making successful investment decisions.

4. What is the difference between comparing large-cap and small-cap stocks? The primary difference lies in the risk and growth potential. Large-cap stocks are generally more stable, while small-cap stocks offer higher growth potential but with increased risk.

5. How does market sentiment affect stock comparison? Market sentiment can drive stock prices independently of financial metrics, especially in the short term. Understanding sentiment is crucial for effective stock comparison.

Discover how tallwin life offers innovative health and wellness solutions to enhance your daily routine. Explore their products and services for a healthier, balanced lifestyle today!