Introduction

Every trading day presents new opportunities, and one of the most exciting moments for traders is the pre-market session. Understanding pre-market gainers can provide a significant advantage. This blog post explores everything you need to know about these early movers.

What are Pre-Market Gainers?

Pre-market gainers are stocks that show significant positive movement in price compared to their previous close, all before the official market opening. This activity can indicate potential trends and trading opportunities.

Why Pre-Market Trading Matters

Pre-market trading offers insights into market sentiment and potential price movements. For many traders, pre-market gainers serve as a barometer for the day’s trading potential.

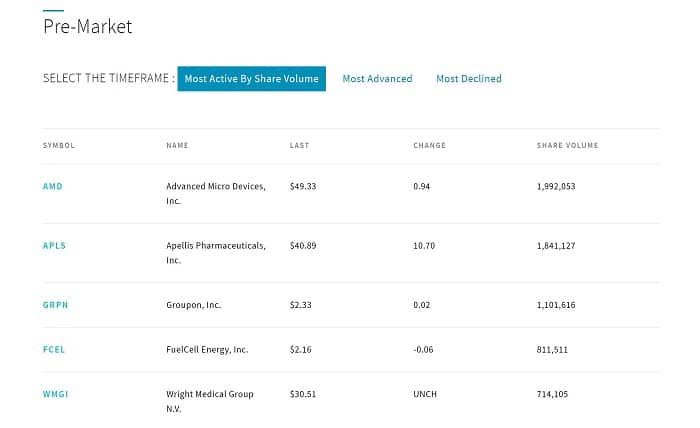

How to Identify Pre-Market Gainers

Identifying pre-market gainers involves monitoring stock news, earnings announcements, and other market-moving events. Utilizing trading platforms with robust pre-market data is crucial.

The Role of News in Pre-Market Movements

News plays a pivotal role in stock movements during the pre-market session. Positive news can drive a stock’s price up, making it a pre-market gainer, while negative news can have the opposite effect.

Tools and Platforms for Tracking Pre-Market Gainers

Several tools and platforms are available for traders to track pre-market gainers. These include brokerage platforms, financial news websites, and specialized trading apps.

Volume and Its Impact on Pre-Market Gainers

Volume is an essential factor in validating the movement of pre-market gainers. Higher volume indicates stronger interest and a more sustainable price movement.

Strategies for Trading Pre-Market Gainers

Trading pre-market gainers requires specific strategies. These can include setting stop-loss orders, watching for quick exits, and capitalizing on momentum.

The Risks of Trading Pre-Market Gainers

While trading pre-market gainers can be profitable, it also comes with risks such as higher volatility and lower liquidity. Understanding these risks is crucial for every trader.

Case Studies: Successful Trades with Pre-Market Gainers

Exploring several case studies of successful trades can provide practical insights into how seasoned traders leverage pre-market gainers for substantial profits.

How to Integrate Pre-Market Data into Your Trading Routine

Integrating pre-market data effectively into your trading routine can help you make more informed decisions. This section discusses techniques to incorporate this data seamlessly.

The Future of Pre-Market Trading

Looking forward, pre-market trading is likely to become more integrated with mainstream trading practices as technology advances and more traders recognize its potential.

Conclusion

Pre-market gainers offer a window into potential market movements and can be a valuable indicator for day traders. By understanding and strategically trading these early movers, traders can enhance their chances of success in the fast-paced world of stock trading.

FAQs

1. What exactly are pre-market gainers? Pre-market gainers are stocks that show significant positive movement in price before the market officially opens.

2. How can I track pre-market gainers? You can track pre-market gainers using specialized trading platforms and financial news websites that provide pre-market data.

3. What are the risks associated with trading pre-market gainers? The primary risks include increased volatility and lower liquidity, which can lead to larger than expected losses.

4. Can news significantly affect pre-market prices? Yes, news can have a significant impact on stock prices in the pre-market session, driving them up or down based on the nature of the news.

5. How do I incorporate pre-market data into my trading strategy? Incorporating pre-market data involves regularly monitoring pre-market sessions, using reliable platforms, and integrating this data with broader market analysis to make informed trading decisions.